We invite you

to invest together

with us

01

Whoever feeds

10 billion people

02

03

will definetely rule the world

001

Our mission

objectives

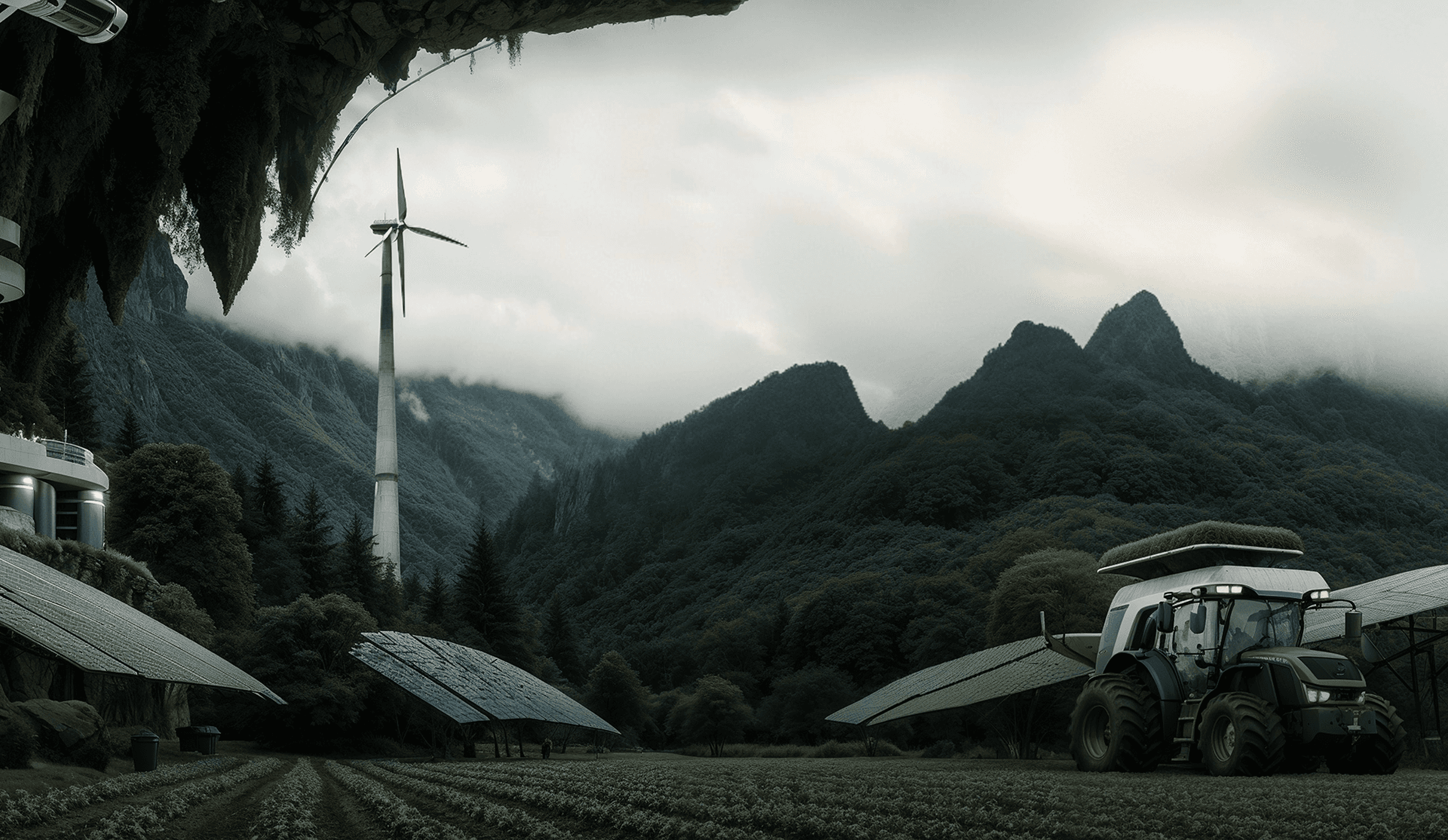

Our mission is to reshape agriculture into a sustainable, innovation-led industry. We integrate capital with advanced technologies and operational expertise, building resilient agribusinesses that deliver consistent returns while addressing global food security.

002

Global agri

capital trends

The world is growing fast — more people, more food. The climate is changing — old methods no longer work.

Investors are seeking stable assets, and agriculture will always remain the foundation of the economy.

01_SIM

$13B

Size of Israel’s agrifood market by 2025

02_FDTCH

$ 4.1B

Invested in Agritech and FoodTech startups in 2024

03_FV

47.5%

Share of fruits & vegetables, our primary focus

003

Our proven

playbook

Our focus is on fruits and vegetables — segments with stable demand and high margins, where every innovation quickly translates into profit growth

We invest through minority stakes of up to 50%, keeping owners in the game and strengthening their motivation. This format reduces risks and creates a partnership where both sides are equally invested in achieving the best results.

Step_1

Entry

Repay debts and provide liquidity to shareholders.

We enter the business with capital that addresses two goals at once: we settle the company’s debts and provide liquidity to shareholders. This relieves financial pressure and creates room for growth.

Step_2

Transformation

Deploy next-gen greenhouses, drones, IoT and AI analytics.

Money is just the beginning. We implement a package of technologies: next-generation greenhouses, drones, IoT sensors, and AI analytics. Alongside this comes managerial expertise and new standards of operational efficiency.

Step_3

Monetization

Strategic sale, buy-back or IPO.

When the business reaches a new level, we lock in the results. Three scenarios are possible: sale to a strategic player, buy-back by management, or going public through an IPO.

004

capital always come along with the expertise

Big strategy

We start with 3—5 companies and deliver EBITDA growth of x1.5—2. After that, we replicate the model by adding new companies.

Next, we build a «virtual holding» with shared IT, R&D, and marketing. This drives the business multiplier from 3—5 up to 8—10, while investor IRR reaches 20—25%.